Payroll calculator paychex

Your clients will benefit from increased payroll control with an extensive number of earnings and deduction fields access to flexible labor distribution options quick paycheck. Restaurant owners and managers must add finalizing their previous years accounts and navigating restaurant payroll and taxes to an already demanding job.

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

You can save on federal state and local taxes for many medical and dependent care expenses when you put pre-tax dollars into your flexible spending account FSAIn fact FSA participants save an average of up to 40 percent each year on many out-of-pocket expenses.

. Benefits of Using a Payroll Calculator. Background checks help protect employers by allowing them to confirm applicant credentials and skills before the hire. America Works Because Were Working for America National Payroll Week September 5-9 2022 celebrates Americas employees and the payroll professionals who pay them.

Both ADP and Paychex offer entry-level DIY payroll services that scale up easily. Its a record of an employees compensation benefits and taxes withheld for a given tax year. Thats why Paychex tailors its payroll plans by business size.

In addition it includes powerful features like a check calculator to figure gross-to-net checks online. The bottom line. Wave payment processing fees.

Fast easy accurate payroll and tax so you save time and money. Together through payroll withholding we contribute collect report and deposit 70 of the US. Heres a closer look at what owners need to know and how the Paychex FICA tip credit calculator can help.

Paychex has been recognized as one of the top training organizations in the world with a 2022 Training APEX Award presented by Training magazine. 1 per transaction for bank payments ACH. There are four small business solutions in the ADP Run line.

One of the most useful and sought after this paycheck calculator quantifies take-home pay for salaried employees. Please note that eligible expenses will be reimbursed in full up to 2850 for medical expenses. Payroll steps from the US.

One simple seamless experience. The earlier you start contributing to a retirement plan the more the power of compound interest may help you save. Is an American business software company that specializes in financial softwareThe company is headquartered in Mountain View California and the CEO is Sasan GoodarziIntuits products include the tax preparation application TurboTax personal finance app Mint the small business accounting program QuickBooks the credit monitoring service Credit Karma and.

29 060 per transaction for card payments 34 060 for card payments from American Express. You can also use the same tool to calculate hypothetical changes such as withholding more money from each paycheck or increasing your retirement contributions. As one of the most fully featured free payroll programs for small businesses Payroll4Free is our top free software recommendation.

Ive kept this spreadsheet fairly basic so depending on your business and policies you may find that you need to add more columns. Of the five or so that do Paychexs is easily the best. The Work Opportunity Tax Credit WOTC has been extended through 2020.

The IRS Form W-2 is an employees Wage and Tax Statement. Pre-Employment background checks were once considered a luxury among small business owners but in todays competitive hiring landscape pre-employment background checks can be a vital part of the hiring process. Payroll Time Attendance Benefits Insurance HR Services Support.

There are many benefits of using a payroll calculator including the ability to estimate your paycheck in advance. Calculate gross pay based upon take-home pay and allow for adjustments in 401k premiums and insurance. Instant Payroll Changing the Way Payroll is Managed.

Stella Morrison contributed to the writing and research in this article. Every plan includes payroll processing and payroll tax help and most plans include some HR basics too. The Paychex Flex app has 48 stars out of five on Apples App Store and 41 on Google Play.

Paychex Retirement Calculator Information. Using eSmartPaycheck you can prepare paychecks calculate federal and state taxes print checks and pay stubs and print 941 and W2 forms for free. Handling employee taxes in the restaurant industry is.

Employees in California have multiple options when it comes to saving for retirement. Along with a 401k if employers offer such a retirement program through company benefits there is also a state-sponsored retirement program that has begun rolling out over the past few years. Essentials Enhanced Complete and HR Pro.

By accurately inputting federal withholdings allowances and any relevant exemptions consider this paycheck calculator a strong. Small Business Payroll 1-49 Employees Midsized to Enterprise Payroll 50-1000 Employees Time Attendance. Paychex with helpful videos on 401k basics why you should enroll and how to enroll as well as a retirement calculator and informative articles.

Treasurys annual revenue about 24 trillion per year. Whats included in Waves free plan. Only a few payroll providers offer employer-facing mobile payroll apps.

It offers solutions for 1 to 9 employees 10 to 49 employees and 50 to 1000 employees. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. Learn more about 401k options opportunities to save with the state.

HRmys free payroll app and availability in 65 languages. Learn the benefits of a simpler way to enroll in a 401k plan from the number one 401k recordkeeper in the US. Paychex ranked number five on the list its highest-ever ranking after 21 consecutive appearances including a number seven ranking in 2021.

IRS withholding calculator. With this WOTC calculator Paychex can help you determine your potential savings. All invoicing and accounting features except payroll.

If you frequently run payroll on the go Paychex might be the best small-business payroll software for you. If youre fine with open-sourced software TimeTrex Community Edition offers nearly as many features as Payroll4Free with stellar time-tracking integration. Paychex Flex Time our cloud-based time and attendance system is fully integrated with our all-in-one platform Paychex Flex helping you save time and prevent errors while single sign-on connects employees with the information they need across devices locations and services.

Our easy to use state unemployment insurance SUI calculator provides your annual potential SUI savings with just a few metrics about your employees.

Honey Powder Uses And Benefits In 2022 Debt Payoff Debt Credit Card Balance

1

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

How To Calculate Retroactive Pay Payroll Management Inc

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

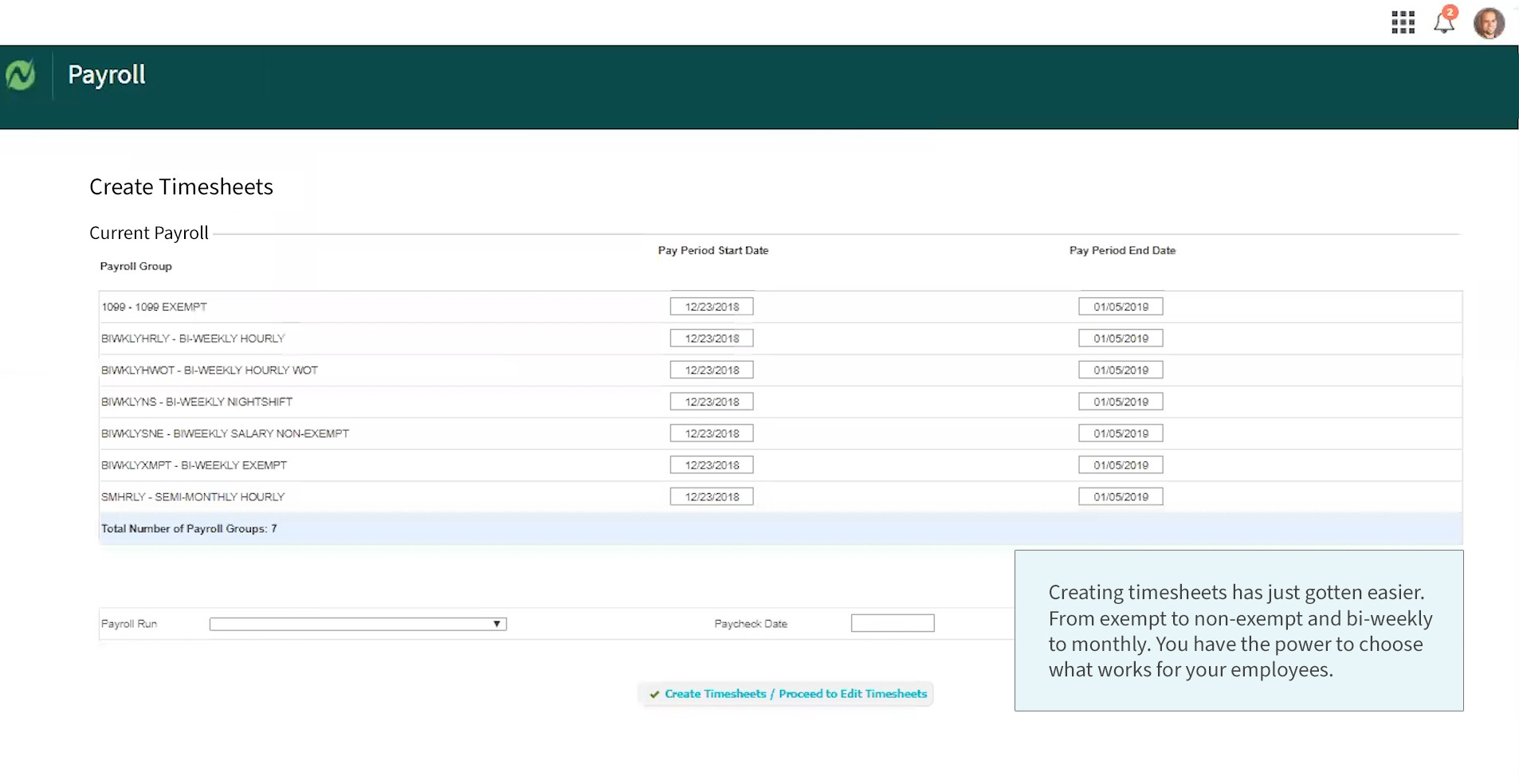

Paycheck Calculator Netchex Payroll Software

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Paycheck Calculator Netchex Payroll Software

Surepayroll How To Calculate Payroll Taxes Youtube

Free Online Payroll Calculator Online Payroll Calculator Employee Payroll Calculator

Paycheck Calculator Salaried Employees Primepay

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

3

Hourly Payroll Calculator

1

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp